what is the tax rate in tulsa ok

When summed up the property tax load all owners shoulder is. The December 2020 total.

The Impact Of The Coverage Gap For Adults In States Not Expanding Medicaid By Race And Ethnicity Kff Medicaid Family Foundations Participation Rate

However it must be noted that the first 1500 dollars spent.

. Property taxes are the cornerstone of local community budgets. In addition to the county and districts like schools numerous special districts like water and sewer treatment plants as well. Oklahoma sales tax details The Oklahoma OK state sales tax rate is currently 45.

The County sales tax rate is. The City of Tulsa imposes a lodging tax of 5 percent. The tax must be paid on the occupancy or the right of occupancy of room s in a hotel.

Tulsa County Oklahoma Property Tax Cleveland County The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

The City of Tulsa imposes a lodging tax of 5 percent. The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is. Once market values are assessed Tulsa together with other in-county public bodies will set tax levies independently.

The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa. This is the total of state county and city sales tax rates.

The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. The Oklahoma sales tax rate is currently. 4 rows The current total local sales tax rate in Tulsa OK is 8517.

The December 2020 total local sales tax rate was also 4867. The Tulsa sales tax rate is. State of Oklahoma 45 Tulsa County 0367.

The state sales tax rate in Oklahoma is 4500. The Oklahoma state sales tax rate is currently. This is the total of state county and city sales tax rates.

Call Our Staff in Tulsa for Info. The Oklahoma sales tax rate is currently. The Tulsa County Sales Tax is 0367 A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

Who is exempt from the tax. The Tulsa County sales tax rate is. Tulsa County OK Sales Tax Rate The current total local sales tax rate in Tulsa County OK is 4867.

The 2018 United States Supreme Court decision in South Dakota v. With local taxes the total sales tax rate. The current total local sales tax rate in Tulsa OK is 8517.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in. Tulsa County collects on average. State of Oklahoma - 45 Tulsa County - 0367.

The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling.

Detailed Oklahoma state income tax rates and brackets are available on this page. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does. The Tulsa sales tax rate is 8517 What is the retail sales tax in Oklahoma.

Yearly median tax in Tulsa County. Some cities and local.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

Individual Income Tax Oklahoma Policy Institute

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

Brandt Vawter Leaves Commissioners Of The Land Office

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

State By State Health Insurance Coverage In 2018 Health Insurance Coverage Health Insurance Types Of Health Insurance

Oklahoma Sales Tax Small Business Guide Truic

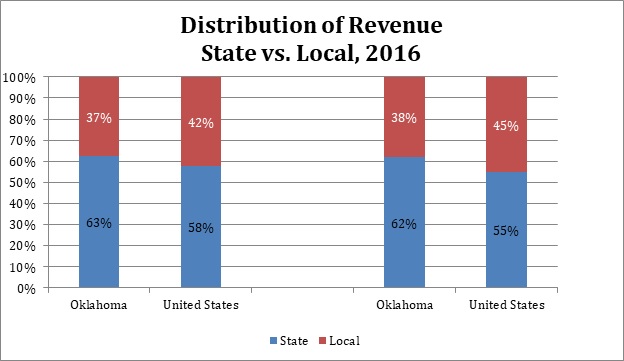

State And Local Tax Distribution Oklahoma Policy Institute

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Tulsa Oklahoma Will Pay You 10 000 To Move There And Work From Home

2022 Oea Legislative Guide In 2022 Checotah Teacher Classroom Teacher Association

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

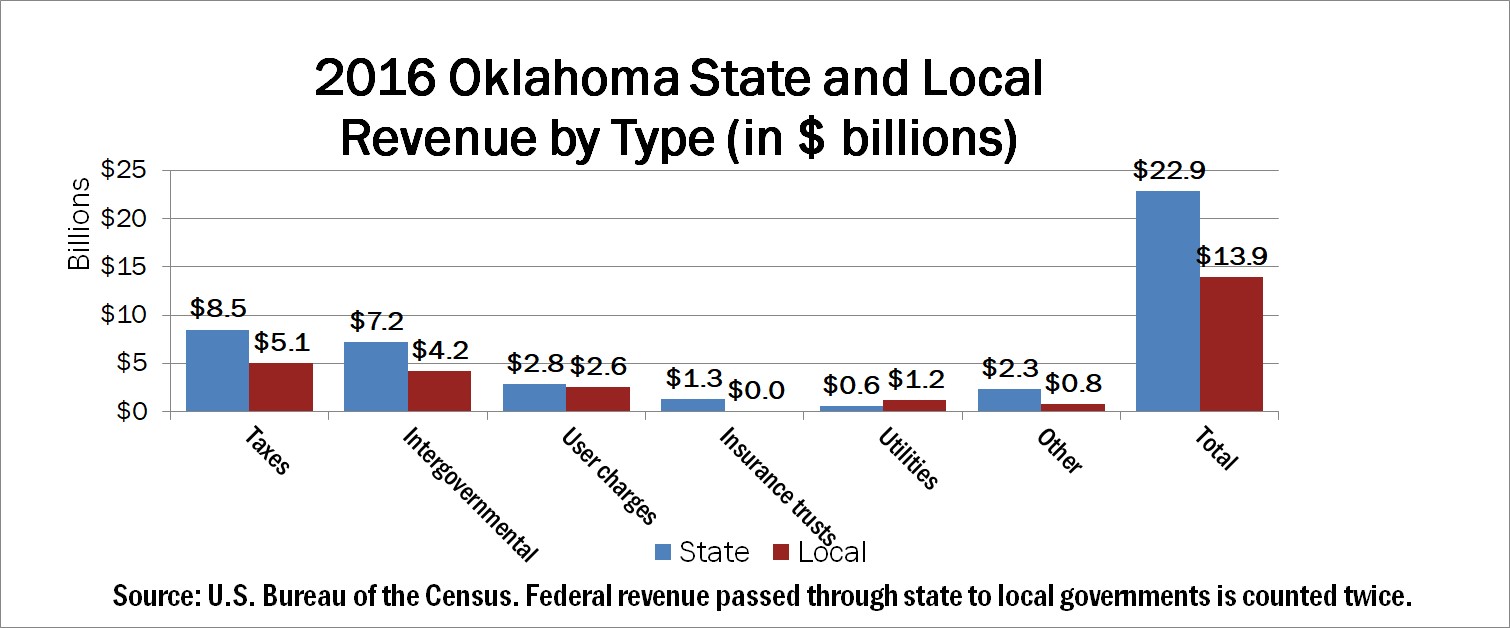

Total Revenues Of Oklahoma Governments Oklahoma Policy Institute